Scams You Should Watch Out For in 2024

Hey, it’s 2024, and the world of scams has become a battlefield of wit.

Criminals are developing new ways to steal and plunder from the common folk.

And the worst part is that you wouldn’t even know you’ve been scammed until after the deed has been done.

A scam’s impact on people’s lives is pretty devastating. You’d be lucky if today’s scams were only after your money.

Some of these scams can not only destroy people’s livelihoods, but we’ve even seen some scams tear families apart, too.

And, according to ExpressVPN’s article, in 2023 alone, Americans will have lost more than $2.7 billion to social media scams.

So, what exactly is a scam?

Well, it is a technique or activity that criminals can use to trick you into giving up your money or something valuable without you suspecting anything is a scam.

For example, you know all those suspicious emails you got from a Nigerian prince telling you to send some money in exchange for their inheritance.

Yeah, those were scams, too.

But Why Do People Still Fall for Scams?

Scams have been around for decades, and with easy access to the internet and other technologies, scammers have upped their game even more.

It’s no longer hard to tell what is a scam and what is legit.

Yes, they are becoming just that good.

But that’s all besides the point. Another reason why many people fall for scams is optimism.

Many people have that feeling that even if the whole world goes to hell, I’ll be safe.

This feeling can make many people lower their guard, and they can very easily ignore the obvious signs of a scam.

The main game of the scammer is to give you a sense of security and get as much out of you as possible before vanishing.

Scams are all just big, intricate psychology games rigged to make you lose as soon as you enter them.

DID YOU KNOW?

The Federal Trade Commission’s (FTC) Consumer Sentinel Network took in over 5.1 million reports in 2022, of which 46 percent were for scams and 21 percent for identity theft.

Credit card scams accounted for 43.7 percent of identity thefts, followed by miscellaneous identity theft at 28.1 percent, which includes online shopping and payment account fraud, email and social media fraud, and other identity theft.

Georgia, Louisiana, and Florida had the most identity theft reports.

Scams You Should Watch Out For in 2024

Scammers will always be out to get you, no matter your age.

They may want your money, your personal information, or even be after your grandma’s secret cookie recipe.

Here are some of the most common scams that you should watch out for in 2024.

Deepfakes and AI Scams

Have you seen that one Ad of Mr. Beast selling $2 iPhone 15 Pros on TikTok?

Then you’ve probably come across a deep fake scam.

In most cases, you’d probably have thought of this as a fake or a scam, but based on Mr. Beast’s past videos, many fell for this.

So, what exactly is a deep fake scam?

When scammers use publicly available data, like voices and pictures of celebrities, loved ones, or relatives, and create some very realistic and convincing media that will make you give your hard-earned cash to them.

With how AI is shaping filmmaking and storytelling, in the future, scammers will use more complex generative AI to aid in their schemes.

Tech Support Scams

Well, you might have seen or heard of this scam.

It is a pretty common type of scam that targets primarily older adults.

For example, you’re surfing the net and minding your business when a popup on the screen suddenly grabs your attention.

“Warning!— Virus Detected. Please Call Technical Support at +971-X”

While most know it’s just a simple ad, older adults who are not tech-savvy would likely try to call the number in the ad to fix the issue.

On the other end, they will be greeted by a sweet, reassuring voice.

The scammers of this type of scam use petty tactics to scare older people into spending what little money they have in the assurance of fixing their computers.

Emergency or Grandparent Scams

This one is also targeted at older people.

It typically involves getting calls or emails from someone claiming to be your loved one or a relative who has been in an accident or arrested and urgently needs money.

The setting remains the same, no matter what they tell you.

So, how do they deceive your grandpa into believing that it’s you who is calling?

Well, they use a trick (spoofing) to make the caller ID look like it is a call from you.

Online Job Scams

With the economy on the decline and a flux of massive layoffs from big tech companies, everyone is looking for a job these days.

And scammers didn’t even leave this opportunity alone.

It usually targets recent graduates who know little about the working world.

Scammers posted job postings on many online forums and platforms for data entry positions with minimal work and attractive pay.

And it is also a job with no prior experience required.

So, when someone applies, the application process will go smoothly with little to no interview.

And after you’ve provided the company with your personal details, it will vanish.

Many scammers use this method to do identity theft and fraud.

They use the victim’s information to open fake credit cards or take out loans that will never be paid off.

IRS Scams

This one is also a widespread scam that targets the naivete of older people.

Usually, the scammers posing as IRS agents call you and tell you that you owe the IRS money in back taxes and fines.

And if the payment is not made, you’ll be arrested and sent to jail. They also have the police on the way to stop you immediately.

Besides, these scammers rush the victim to pay or face the consequences.

But the victim can be assured that if they pay, everything will go away. Also, they can wire them the money directly or even use gift cards to pay their back taxes.

Well, the only consequence of this is that the elderly victim loses a lot of their hard-earned money.

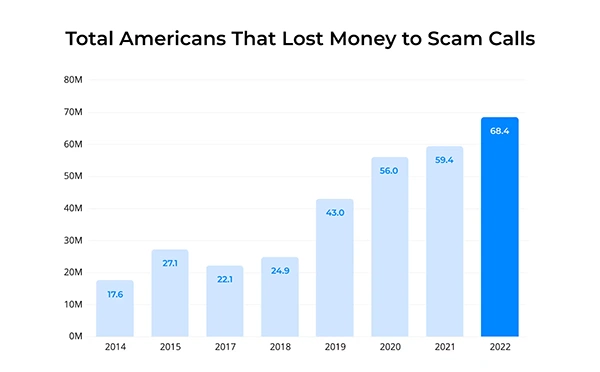

Around 68.4 million Americans have fallen victim to scam calls in 2022, compared to 59.8 million people in 2021. Over the past eight years, the total money lost to US scam calls has grown significantly. In the past 12 months, an estimated USD 39.5 billion* was lost to phone scams. This is a 32.5% increase compared to last year’s USD 29.8 billion.

How Do You Spot a Scam?

Well, scammers are pretty good at what they do.

They play with the psyche of the victim and create a situation in which the victim is in a rush.

So, how can one tell if they are involved in a scam?

Here are some signs that can help you spot a scam.

So, if you spot any of these things, think, stop, and walk away because you’re probably the target of a scam.

They Called You First

Usually, when you want something from a business, you call them first.

You can be assured that the person on the other end of the line is a legit agent who works for the business.

PS: Make sure to call an official helpline and not some random number that pops up on your screen.

But in a scam, the perpetrator calls you.

Also, even if the email or caller ID looks legit, it can be fake.

You’ll Get Something Out of It— Usually Money

Let’s face it…

It’s pretty hard to walk away from a considerable amount of money.

You can pay off all that student loan, get rid of some of that third mortgage on your house, and pay off your mom’s medical bills.

Scammers will always try to take advantage of your desperate situation.

So, if someone out of nowhere is trying to give you a prize, money, or a loan for next to nothing, it’s probably a scam, and you need to walk away.

They Want Your Personal Information

They are calling and asking for you to give them your personal information so they can verify if it’s you.

It can be anything, from your bank account number to your social security number or DOB.

Please be on high alert in such cases.

And don’t give this info away so quickly; you are pretty close to becoming the victim of identity theft.

You Need to Pay Them First

Well, if someone is giving you a prize, debt relief, or some employment, you need to pay a small amount to get things rolling.

You are the victim of a scam, so stop right there.

Wiring Money Offshore or Paying With Gift Cards

If they are trying to get you to wire money to an offshore account or send them some gift cards.

You’re probably in a scam.

No legitimate business or government entity will receive money in such a way.

It’s more than likely that a scammer is on the other end.

Psychology of Scams

Scammers are pretty good at manipulating the psyche of their victims.

And they often target vulnerable or naive people.

They use compelling storytelling to hook their victims into the scenario.

Then, they will create a situation where they will rush you to give them the money or be left with the consequences.

Or they can even entice you, saying that you’ll probably lose this once-in-a-lifetime opportunity if you do not pay them.

And once you are in that mindset, they will squeeze you dry.

So, there are three steps to a scam:

1. Immerse them in their story.

2. Create a situation where you’ll rush to get things done.

3. Once you’re hooked, they get as much money out of you as they can.

TL;DR

Anyone can become the victim of a scam.

With the latest tech and innovations, scammers are coming up with new and innovative ways to play with the psyche of their victims.

You need to understand that no matter how much knowledge you gain, scammers will still find a way to get you to fall for their schemes.

You need to know about some of the most common ways that people can get scammed and how to spot if you’re in one.